7.3: Competitive Advantage

- Page ID

- 22763

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)What do Walmart, Apple, and McDonald's have in common?

All three businesses have a competitive advantage. What does it mean when a company has a competitive advantage? What are the factors that play into it? Do they achieve a competitive advantage in the same way? According to Michael Porter in his book "Competitive Advantage: Creating and Sustaining Superior Performance," a company is said to have a competitive advantage over its rivals when it can generate profits that surpass the industry average and continue to do so over time. Porter identified two basic types of competitive advantage:

- Cost advantage: A firm has a cost advantage when it can deliver the same benefits as competitors but at a lower cost. McDonald's and Walmart utilize economies of scale to maintain their cost advantage.

- Differentiation advantage: A firm has a differentiation advantage when it can deliver benefits that exceed the competing products. Apple's innovative products are known to be easy to use, complement each other, and share the same operating system. They offer a unique user experience that gives consumers a sense of exclusivity, and their trade-in programs build consumer loyalty.

The question, then, is: How can information technology be a factor in achieving a competitive advantage? We will explore this question through two analysis tools: from Porter's book "Competitive Advantage: Creating and Sustaining Superior Performance:"

- The Value chain

- The Five Forces Framework

We will discuss how Porter used the Five Forces framework to evaluate the influence of the Internet and IT on the profitability of an industry.

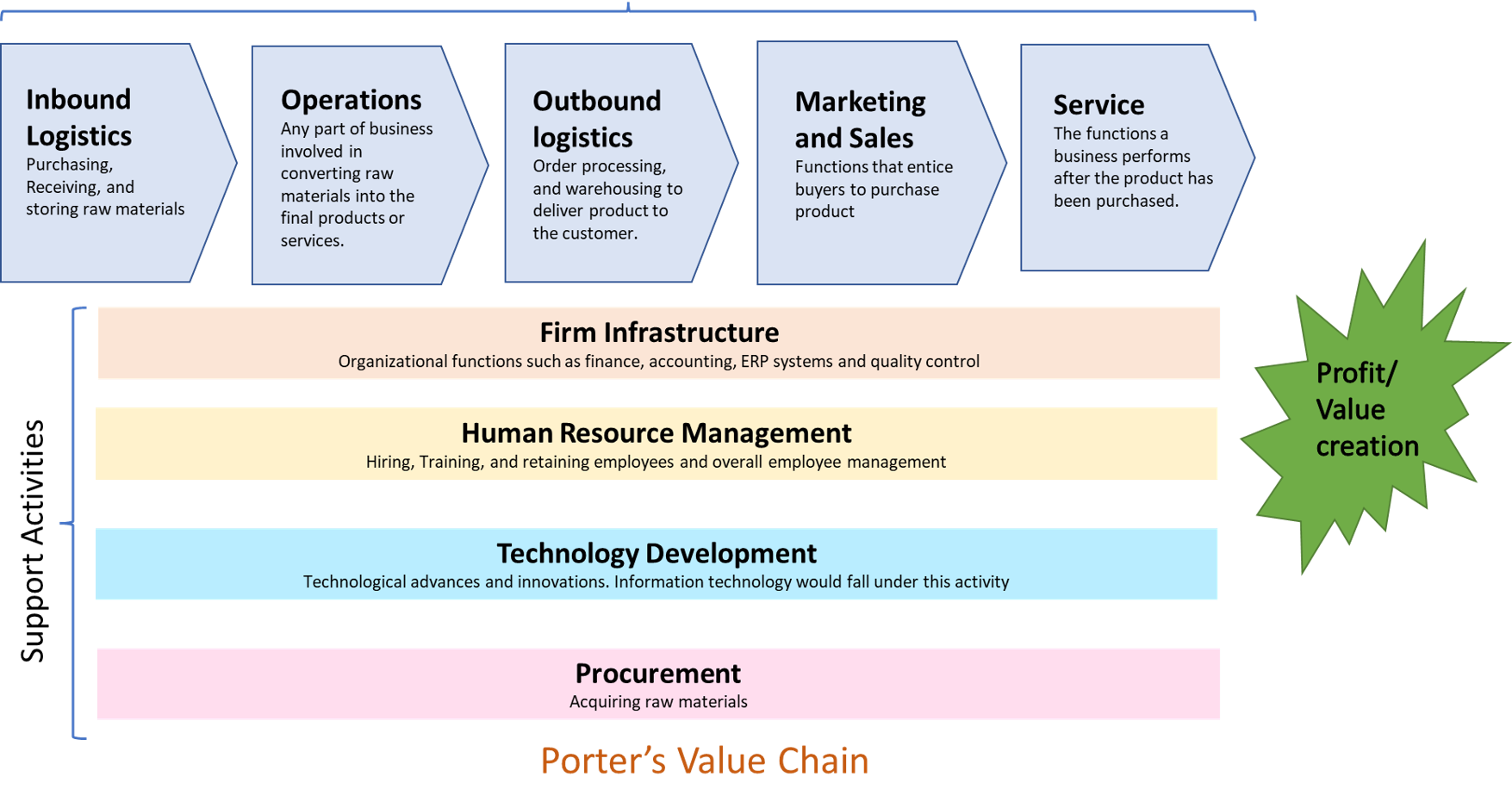

The Value Chain

Porter analyzes the basis of competitive advantage and describes how a company can achieve it using the value chain as a framework. A value chain is a step-by-step business model transforming a product or service from an idea (i.e., materials) to reality ( i.e., products or services). Value chains help increase a business's efficiency so the business can deliver the most value (i.e., profit) for the least possible cost. Each step (or activity) in the value chain contributes to a product or service's overall value. While the value chain may not be a perfect model for every type of company, it provides a way to analyze how a company produces value.

The value chain is made up of two sets of activities: primary activities and support activities. We will briefly examine these activities and discuss how information technology can create value by contributing to cost advantage or differentiation advantage, or both.

The primary activities are the functions that directly impact a product or service's creation, sales, and after-sales service. The primary activities aim to add more value than they cost. The primary activities are:

- Inbound logistics: Purchasing, Receiving, and storing raw materials. Information technology can make these processes more efficient, such as with supply-chain management systems, allowing suppliers to manage their inventory. Starbucks has company-appointed coffee buyers that select the finest quality coffee beans from producers in Latin America, Africa, and Asia.

- Operations: Any part of a business involved in converting the raw materials into the final products or services is part of operations. From manufacturing to business process management (covered in Chapter 8), information technology can provide more efficient processes and increase innovation through information flows.

- Outbound logistics: These functions include order processing and warehousing required to deliver the product to the customer. As with inbound logistics, IT can improve processes, such as allowing for real-time inventory checks. IT can also be a delivery mechanism itself.

- Marketing/Sales: The functions that entice buyers to purchase the products (advertising, salesforce) are part of sales and marketing. Information technology is used in almost all aspects of this activity. From online advertising to surveys, IT can innovate product design and reach customers like never before. The company website can be a sales channel itself.

- Service: The functions a business performs after the product has been purchased, such as installation, customer support, complaint resolution, and repair to maintain and enhance its value, are part of the service activity. Service can also be enhanced via technology, including support services through websites and knowledge bases.

The support activities are the functions in an organization that support and cut across all primary activities. The support activities are:

- Firm infrastructure: Organizational functions such as finance, accounting, ERP Systems (covered in Chapter 9), and quality control, all of which depend on information technology.

- Human Resources Management: Hiring, training, and retaining employees and overall employee management are needed for marketing, logistics, and operations that benefit all primary activities.

- Technology development: Technological advances and innovations support primary activities. These advances are integrated across the company to add value to different departments. Information technology would fall specifically under this activity.

- Procurement: Acquiring the raw materials used to create products and services is called procurement. Business-to-business e-commerce can be used to improve the acquisition of materials.

A value chain is a powerful tool for analyzing and breaking down a company into relevant activities that result in higher prices and lower costs. By understanding how these activities are connected and the company's strategic objectives, companies can identify their core competencies and insight into how information technology can be used to achieve a competitive advantage.

Starbucks value chain model analysis

When you think of international coffee shops, Starbucks is the first name that comes to mind. You can conduct a value chain analysis to understand how it maintains its competitive edge and success through its activities, and which of the activities or groups of activities are the source of its competitive advantages.

Solution

Review this example of the Starbucks value chain model analysis, including a short video by Prableen Bajpai: Analyzing Starbucks Value Chain Model.

Have a look at this infographic showing Starbuck's value chain analysis.

Figure \(\PageIndex{3}\): Infographic showing Starbuck's value chain analysis using Porter's value chain model. Image by Tejal Desai-Naik licensed under CC-BY-NC.

As you can see from our value chain analysis of Starbucks, the company follows a unique operational plan in that it controls everything from production to sales. This gives it a competitive edge and enables substantial profit generation.

Porter's Five Forces

Porter recognized that other factors could impact a company's profit in addition to competition from its rivals. He developed the "five forces" model as a framework for analyzing the competition in an industry and its strengths and weaknesses. The model consists of five elements, each of which plays a role in determining an industry's average profitability.

In 2001, Porter wrote an article entitled" Strategy and the Internet," in which he takes this model and looks at how the Internet(and IT) impacts an industry's profitability. Although the model's details differ from one industry to another, its general structure of the five forces is universal. Let's have a look at how the internet plays a role in Porter's five forces model:

- Threat of New Entrants: The easier it is to enter an industry, the tougher it will be to profit in that industry. The Internet has an overall effect of making it easier to enter industries. Traditional barriers are drastically reduced, such as the need for a physical store and a sales force to sell goods and services. Dot-coms multiplied for that very reason: All a competitor has to do is set up a website. The geographical reach of the internet enables distant competitors to compete more directly with a local firm. For example, a manufacturer in Northern California may now have to compete against a manufacturer in the Southern United States, where wages are lower.

- Threat of Substitute Products: How easily can a product or service be replaced with something else? The more types of products or services there are that can meet a particular need, the less profitability will be in an industry. For example, the advent of the mobile phone has replaced the need for pagers. The Internet has made people more aware of substitute products, driving down industry profits in those industries being substituted. Any industry in which digitized information can replace material goods such as books, music, and software is at particular risk. For example, Amazon's Kindle and other ebook readers are a threat to paper books and magazines.

- Bargaining Power of Suppliers: Companies can more easily find alternative suppliers and compare prices more easily. When a sole supplier exists, then the company is at the mercy of the supplier. For example, if only one company makes the controller chip for a car engine, that company can control the price, at least to some extent. The Internet has given companies access to more suppliers, driving down prices. On the other hand, suppliers now also have the ability to sell directly to customers. As companies use IT to integrate their supply chain, participating suppliers will prosper by locking customers and increasing switching costs.

- Bargaining Power of Customers: A company that is the sole provider of a unique product has the ability to control pricing. But the Internet has given customers access to information about products and more options (small and big businesses) to choose from.

- Competitive Rivalry within an industry: The more competitors, the bigger a factor price becomes. The visibility of internet applications on the Web makes proprietary systems more difficult to keep secret. It is straightforward to copy technology, so innovations will not last that long. For example, Sony Reader was released in 2006, followed by Amazon Kindle in 2007, and just two years later, Barnes and Noble Nook, which was the best-selling unit in the US before iPad (with built-in reading app iBooks) hit the market in 2010. (Wikipedia: E-Reader, 2020)

According to this framework, the company's average profitability depends on the five forces' collective strength. If the five forces are intense, for example, in the airline industry, almost no company makes a huge profit. If the forces are mild, for example, the soft drink industry, there is room for higher profits. The Internet provides better opportunities for companies to establish strategic advantage by boosting efficiency in various ways, as we will see in the next section. However, the internet also tends to dampen suppliers' bargaining power and increase the threat of substitute products by making it easier for buyers and sellers to do business. Thus, the Internet (and, by extension, information technology in general) has the overall impact of increasing competition and lowering profitability. This is the great paradox of the internet.

While the Internet has certainly produced many big winners, the overall winners have been the consumers, who have been given an ever-increasing market of products and services and lower prices.

References

Bajpai, P (2020). Analyzing Starbucks Value Chain Model. Retrieved August 16, 2020, from https://www.investopedia.com/articles/investing/103114/starbucks-example-value-chain-model.asp

Porter, M. (2001). Strategy and the Internet. Harvard Business Review. Retrieved August 20, 2020, from http://hbswk.hbs.edu/item/2165.html