3.5: Criteria for a Competitor Analysis

- Page ID

- 22158

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)The following themes, as well as those I mention in Figure 2.1, should be investigated, and thoroughly presented, as part of the criteria used for the 'direct' competitor portion of any feasibility study.

- Similar attributes in products and services

- Pricing within plus or minus 15 percent

- The proximity of the operation (1 mile? 3 miles?)

- Hours of operation

- Style of service

- Menu pricing

- Beverages offered

- Menu offerings

- Other general attributes

Similar attributes

A direct competitor is normally in the same business segment as your operation. What products and services do these operations offer to the trading area? I s there an over-abundance of one type of product and very little of another? Is the marketplace entirely lacking entirely in a type of product that you are competent to produce? If you can fill a niche in the trading area that does not exist, you would initially have little to no direct competition - which is always a plus.

Similar pricing

Customers in your direct business segment will typically be within, plus or minus, fifteen percent of the current competitive price range in the marketplace, or within fifteen percent of the pricing structure, your concept intends to use. Understanding your competitions 'pricing’ is another important aspect that directly relates to value in the minds of consumers. In general, consumers typically have a price point in mind that they will not exceed - to pay more erodes the value of the meal. Of course, which price is acceptable, and which price tips the scale in the negative direction, is a psychographic issue. Be aware of how your potential competitors are handling the pricing function from the 'value' perspective. Are they discounting the price with specials on certain nights of the week? How do they treat pricing in their competitive advertising scheme?

Competitor proximity

Trading areas generally do not extend beyond a three- mile radius of a foodservice operation. Although, some factors may help a restaurant to extend its pull beyond the three mile demarcation - or actually cause that radius to shrink to one mile or even much less. In a small community, consumers may be willing to drive across town for lunch if the traffic patterns are such that the trip completion can occur in five or ten minutes. On the other hand, downtown areas, for example, may pose parking difficulties for consumers who do not want to leave and give up their parking spot for a meal. In such cases, having a location within walking distance can be a necessity to reach the intended consumers of an operation. In yet another situation, in a prime downtown entertainment area of a city, the consumer may be moving from one venue to another, meeting friends, or looking for a quick meal. A foodservice operation one block away from the activities could be off the beaten path and considered out of the way - even though the distance a consumer would have to travel is one block. Where your competitors are located and how close to each other, and your operation, could make a huge difference in terms of your operation's success. Always consider the proximity of other competitors. Why are they located there? Does a strategic advantage exist from their location?

Hours of operation

Most foodservice operations do the majority of their business during lunch and dinner service. Quick service restaurants (QSR) are typically open the largest number of hours per day serving all day parts. Casual restaurants will also make themselves available to the consumer for most day parts including late evenings in some cases. The fine-dining restaurants are typically productive during the lunch and dinner portions of the day. What hours of operations and day parts are your competitors utilizing in their respective marketing mix scheme? In a downtown location surrounded by many businesses and possibly government offices, it might make sense to open for breakfast as workers arrive early and are looking for coffee and something quick to sustain them until lunch. Breakfast can also introduce customers to your concept and help them to become better acquainted with your menu offerings during lunch and dinner. At the other end of the day, an entertainment district in a trading area may practically limit the hours of operation to dinner service and late-night business.

Take a moment to not only know just who your competitors are in terms of 'name' and ‘menu’ but equally begin to dissect their target market. Where are they located in terms of that market, and how each competitor addresses the market from their own perspective of what it means to compete in that area? For instance, Outback Steakhouse opens for ‘dinner only’ in most markets and does not accept reservations. Is this necessarily what the trading areas truly desires? The answer lies in Outback's operation strategy. They do not feel they are at their competitive best trying to extend to the other day parts. Another issue for this company is the number of trained employees necessary to sustain multiple day parts based on the size of their operation and the volume they must do to be successful. From their perspective, they are at their best for dinner and thus attacking this service segment alone gives them the best opportunity to top the competition.

Style of service

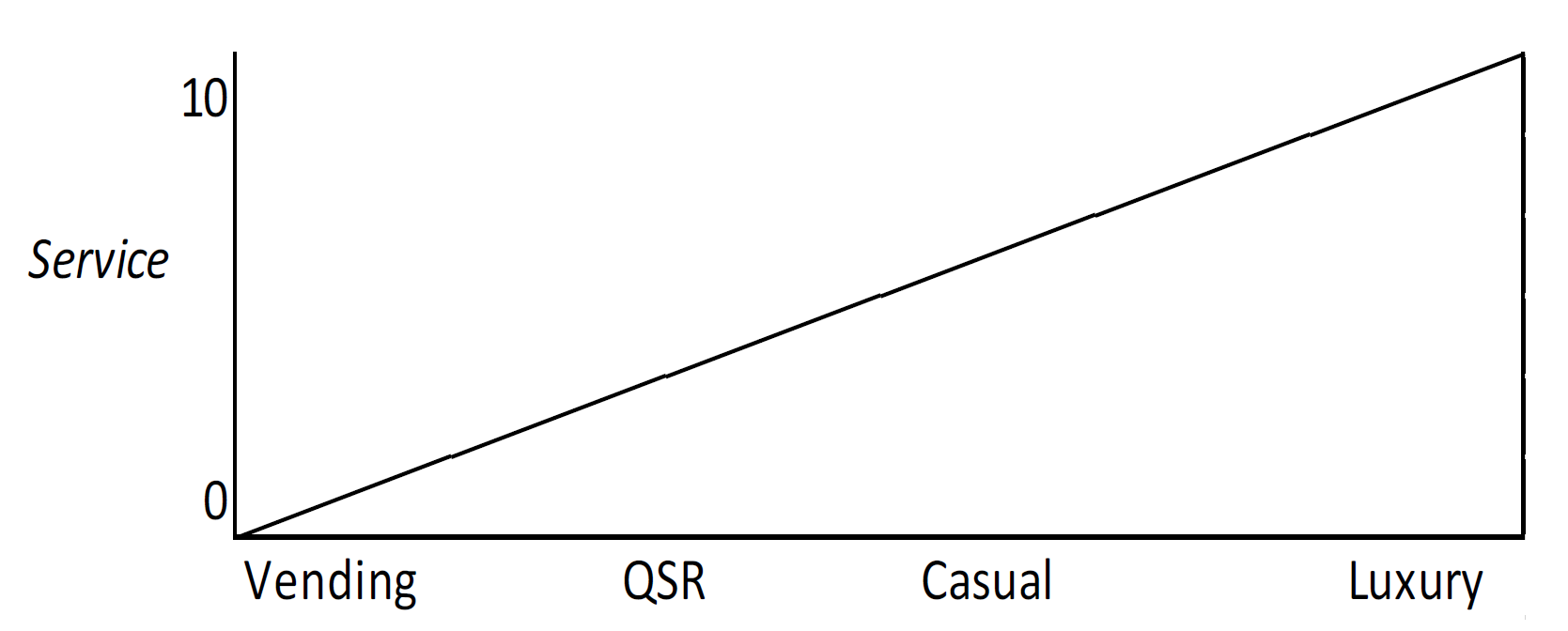

Service can be a moving target for many restaurant operations. From a broad perspective, as Figure 2.3 illustrates, the least amount of service required for food delivery would be the vending machine increasing along the scale to high customer attention in a fine dining establishment.

Service is essentially an interactive process. How much attention the customer receives is an operational decision that varies from one competitor to another. Service links equally to the restaurant concept and the need, or lack of a need, to turn tables. Thus service is a function of business segment in the sense that quick service restaurants generally provide what might be called 'transactional service,' just enough to complete the transaction at hand. Casual restaurants can provide service ranging from little to adequate service depending on the restaurant theme and method of operation. The highest level of skill and server awareness in typically required in the fine dining segment of the industry.

Figure: 2.3 Service Required by Foodservice Segment

Are your competitors ‘position’ allow them to serve and interact with their clientele? Interaction is an important element of service because this is generally the only point of contact an operation has with a customer. In fact, customers' interaction with the service staff is generally the only interaction a customer will experience with a company. How would you rate your competitors' performance in the area of service? Is service a core strength - or do opportunities exist to better service the trading area?

Menu pricing

Two important concerns are at the forefront of any menu pricing. First is the issue of 'value.' Does the competition have a ‘cost’ or ‘value’ leadership position in

the trading area? Consumers are always value conscious and how much they are willing to pay is typically a major consumer concern. Pricing also speaks to portion size as a value relationship. How do the competitors compare to each other in terms of pricing as it relates to portions and ultimately to the value of the meal? The second issue speaks to the range of pricing competitors use in the trading area. What is the price range for each of your competitors? Where do you see ‘your’ pricing in comparison to others - higher, lower, or within the same range of pricing? Pricing a menu and services too high can give the impression that that your operation is not value conscious. Price to low and many will think what you offer is of inferior quality? You must strike a balance with consumers. Image denotes pricing, pricing confirms image.

Beverages

Beverage sales can be a lucrative profit center for a restaurant operation. Are your competitors taking advantage of beverage sales? Do they sell alcoholic beverages? If

so, do they operate a full bar type of service or is alcohol sales limited to simply beer and wine? Is their approach to beverage sales effective in your opinion? Can you observe an increase in traffic during different day parts resulting from beverage sales to the operation?

Menu

The menu is a very important aspect of restaurant sales because it is the operation's primary tool to convey the restaurant's theme, 'position' in relation to other competitors, and offerings created to attract consumers. The menu is also the primary and often, the only source of revenue for the operation. Is the menu priced to breakeven, compete

with other competitors, or priced to make a good profit for the establishment. Most competitors have reasons for their offerings and price points. What is the menu saying to you about each particular competitor? The 'size' of the menu in terms of offerings is of importance for several reasons. First, customers demand a good selection of food and beverage items. Realistically, too large a menu is also at the center of an operation's waste issue. Does the competition offer variety in terms of the different types of selections (meat, chicken, seafood, and so forth) offered, or is there an abundance of one or two types of entrees? If the restaurant is quick service, is the menu easily prepared, or does it appear to create difficulty for the employees?

Other questions would include the ethnicity of a menu and how focused toward one cuisine a menu may be. Does the menu change often or is it static? A static menu would remain the same year-round. While a consistent menu has advantages, it can also after time, become repetitive to the consumer. A variable menu, on the other hand, could vary by day, week, month, or seasonally, to take advantage of product availability and pricing.