5.1: Positioning

- Page ID

- 22085

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)- Gain a working knowledge of positioning and the general consideration involved.

- Compare the traditional marketing mix to the hospitality mix.

- Understand the importance of ’packaging’ resources for customer appeal.

- Comprehend and evaluate the different market environments.

- Gain a working knowledge of the various sources of data collection and usefulness.

- Learn how to develop consumer interest.

- Understand the importance of advertising.

- Gain a working knowledge of how to develop a positioning strategy.

- Understand the distinction between different types of restaurants.

“Positioning the brand and regaining trust are all smart things for us to do and those are the litmus tests for any decisions we make.”

John McKinley

“Great marketers have immense empathy for their audience. They can put themselves in their shoes, live their lives, feel what they feel, go where they go, and respond how they'd respond. That empathy comes out in content that resonates with your audience.”

Rand Fishkin

“It's not about market share. If you have a successful company, you will get your market share. But to get a successful company, what do you have to have? The same metrics of success that your customer does.”

Gordon Bethune

Positioning the Product – Service Mix

Positioning is the marketing activity and process of identifying a market problem or opportunity, and developing a solution based on market research, segmentation, and supporting data. Positioning relates to strategy, in the specific or tactical development phases of carrying out an objective to achieve a business or organization's goals, such as increasing sales volume, brand recognition, or reach in advertising.

General Considerations Regarding Positioning

- Positioning starts by segmenting the target market based on the different benefits that each consumer group target seeks from your products or services.

- Positioning is often intuitive. Sophisticated analysis techniques help, but they are not substitutes for think through your marketplace.

- It helps to develop a mental map of where the competitor’s position is to determine factors like benefits and quality features.

- A positioning map is useful to identify opportunities and specify the current and desired positioning of your products and services.

- The goal is to develop a differentiated products or services that creates a unique mind share, particularly in the target market segments you intend to attract.

- You can best attack a competitor’s position by focusing resources and promotion on a ‘particular’ positioning element or quality feature.

- You can best defend your position from competitors by an aggressive, mobile counterattack of re-positioning existing products and introducing new ones.

- Set the price for the product position or service by estimating how much extra quality the product will possess over and above the competition and how much the target consumers are prepared to pay for this extra quality. The answer may be over and above the competition’s actual selling price, or the correct position may be below your competitor’s pricing

- Estimate the financial feasibility of the proposed positioning strategy. Will expected sales and share meet your targets?

After selecting market segments, the operation must develop a positioning strategy for its ‘products and services’ in each target market. Put simply, 'positioning' is the process of determining how to differentiate a firm's product offerings from those of its competitors in the minds of consumers. Positioning answers the question ‘What do we want consumers to think about our company when they see our restaurant, look at our sign, our logo, marketing literature, advertising, and so forth?’ and begins the positioning function. To accomplish this, the operation must know how important certain attributes are to consumers in purchasing the company's products, and the consumers' perceptions of how well the company, and competition, are doing with respect to these attributes (Martin and Daily, 1989). Marketers want to position their products so consumers purchase them instead of competing products.

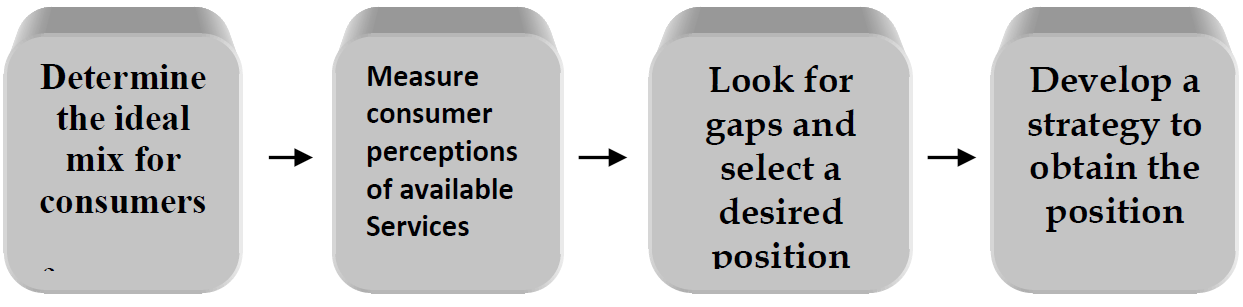

Figure: 5.4 A Positioning Process

For example, operations could base their positioning on intangibles such as food or ambience. Applebee's uses the slogan 'eating good in the neighborhood' to create a personal atmosphere, and Subway uses the slogan 'eat fresh' to focus on food quality and health themes. It would also be possible to use more than one basis for positioning when targeting a specific market. For example, in Subway's case, the positioning extends beyond 'freshness' to 'low calorie' options to bring home the 'healthy’ eating theme. They could easily extend the message to 'lower cost' to move toward affordable healthy eating, and so on.

Several factors could affect an operation's decision regarding which positioning bases it should use. Figure: 5.4 provides a four-step process that considers the factors used to position the products of an operation. First, a company's current market position and the positions of its competitors’ are important. Second, a company should consider the compatibility of a desired position with the needs of consumers and the goals of the firm. Third, a firm must have the resources necessary to communicate and maintain the desired position.

The Ideal Mix for Consumers

At this point, the operation has developed a strategy to attract consumers. Now, the important concern is determining the ideal product and service mix for the trading area consumers. Stated differently: "What are consumers looking for when they purchase products and services?" Once the operation has established this ideal mix of attributes, it can begin to examine the ability of its product-service mix to meet the needs of consumers. There are always salient attributes that are important to consumers in evaluating the alternative products or service offerings. These attributes will differ by product or service, but some of the more important attributes would include price, value, quality of food, type of food, service quality, menu variety, employee friendliness, location, atmosphere, service speed, cleanliness, parking, and so forth.

When you examine the major attributes previously listed, it become obvious that many attributes are important for all products and services. Price is not always the most important attribute but is generally one of the top three. Service quality is another attribute that is important to consumers in choosing service providers, and commonly used to differentiate between brands. Other attributes are generally more specific by the type of restaurant segment.

It is an ongoing necessity for restaurants to obtain importance ratings from consumers on a frequent basis using some form of research. The most common method would be to conduct a survey. Normally, individuals are asked to rate a list of attributes using an importance scale. For example, a restaurant's comment card may ask a customer to rate the quality of food on a scale of 1 to 5, with ‘1’ being "not important at all" and ‘5’ being "very important." The answers to these ratings combine to provide an average rating for each desired target market. The construction of an ideal mix for the restaurant's products can result from the examination of the averages for all of the attributes - a product-service mix comprised of what consumers are looking for. This includes theme and logos, facility, ambience, menu, service style, affordability, methods of product delivery. Maybe at this point, it would be better just to say ‘almost everything’ having to do with what the customer can perceive.

Measure Consumer Perceptions

Once the ideal mix has been determined, the next step is to examine the current offerings of the operation - as well as its competitors - to evaluate their abilities to meet consumer needs. More important, it is necessary to obtain consumer perceptions of your service and your competitor's services. Even if your company believes that their product-service mix offers good value to consumers, this is only true if consumers believe it to be so. From the marketing perspective, perception is everything.

Figure 5.5 Competitive Benefits Analysis

| Potential Benefits | Our Operation | Competitor A | Competitor B |

|---|---|---|---|

| Value for price | |||

| Quality of food | |||

| Quality of service | |||

| Atmosphere | |||

| Location | |||

| Menu Variety |

It would be a critical mistake for a company to assume that it knows what consumers want and that its products and services are meeting consumer’s wants and needs. Once again, it is imperative for a restaurant operation to evaluate consumer perceptions by consumer surveys and other research methods. Table 5.5 offers an example of a competitive benefit matrix that can be useful to restaurants in compiling consumer perceptions for the operation compared to its closest competitors.

At this point, it may be helpful to be able to visualize the information in the competitive benefit matrix by using a 'perceptual map.' Perceptual mapping is a technique used to construct graphic views or representations of how consumers in a market perceive a competing set of products relative to each other because of the difficulties associated with graphing and understanding multidimensional presentations, in evaluating comparisons between alternative brands. For example, consumers might be given the names of restaurants and asked to select the ones most similar or the one that are least similar. Preference data involve asking consumers to indicate their preferences for a list of alternative brands. For competing products, operators must determine which two or three dimensions consumers consider most important, and use these dimensions to construct the perceptual plot.

The points of comparison can vary based on what the restauranteur considers as important elements for comparison to be. For example, quality and price may be important as the example demonstrates, but service versus price, cleanliness versus value, speed of service versus price, type of delivery versus ease in customer acquisition, and so forth can be equally of important to an operation. Using box plots, many points of comparison can paint a clear picture of where the operation fits into the marketplace and how they intend to respond to established competition or deal with new entrants to the market.

This perceptual plot construction uses perceived ‘price’ and perceived ‘quality’ as the two dimensions. Assuming the ratings for each restaurant on these dimensions were collected using consumer research, the placement of the firms in the perceptual space depicts their relative positions in the market. The results of perceptual mapping can be useful for the following purposes:

- To learn how consumers perceive the strengths, weaknesses, and similarities of the alternative product-service mixes offerings;

- To learn about consumer's desires and how these are satisfied or not satisfied by the current products and services in the market; and

- To integrate these findings strategically to determine the greatest opportunities for new product-service mixes, and how a product or service image modification may help to produce the greatest sales increase.

Several methods are useful to construct a perceptual map. Similarity-dissimilarity data involve asking consumers to make direct example, consumers might be asked to rank-order a short list of restaurants or rate a specific restaurant on a 1 to 5 scale, with ‘1’ being "least preferred" and ‘5’ being "most preferred." Attribute data involve asking consumers to rate the alternative brands on a predetermined list of attributes. For example, consumers might be asked to rate a given restaurant based on a series of attributes. After the data are collected, quantitative statistical techniques are useful to reduce the list of attributes into two or three dimensions for easier presentation and interpretation. Then management can use these perceptual maps to fine-tune current product-service mixes and uncover any gaps in market coverage between the ideal mix and the alternative offerings of the operation's competitors.

Look for Gaps in Coverage

Once consumers' perceptions are gathered, measured, and plotted on a perceptual map, the third step in the process is to examine the map for gaps in coverage. Said differently, are there any areas on the map depicting ideal mixes not adequately served by the brands currently in the marketplace? Could there also be a difference between the position sought by management and the position perceived by consumers. For example, Taco Bell entered the market in response to a lack of variety in foods offered by quick service restaurants like McDonald's and Burger King. Further, the creation of extended stay hotels were in response to consumers who had to travel for extended periods and wanted the ability to cook, do laundry, avoid crowded lobbies, and stay in a more residential setting.

The result of the consumer mapping and perceptual mapping enable firms to develop a “positioning statement” which should differentiate the organization's product-service mix from that of their competitors. However, in the twenty-first century, the statement must be original. For many years, restaurants have advertised and promoted "fine food," "prompt, courteous service," elegant atmosphere,' and so forth. As one would expect, these promotional approaches are not as effective as they could be. Consumers usually do not believe such statements because they have heard them too many times before and have often been disappointed when they patronize the restaurants that had made these promotional claims. These statements do little to separate the organization's product-service mix from that of the competitors. If other hospitality organizations are promoting 'fine food' or similar benefits, then all the promotion and advertising appears to be the same in the eyes of the consumers.

In the QSR sector, how many television commercials show smiling well-spoken people working the drive-through painting the perfect picture of the operation? However, when you ‘visit’ the restaurant drive-through, you get the ‘peanuts parents’ (they go wah, wah, wah, – you don’t get Charlie Brown or Lucy) you cannot understand what they are saying - except for the ‘suggestive sell’ that sounds like they are beyond fed up with having to say it. The advertising conveys the right message, but the physical reality of what you can expect tells you the message is false. Advertising aims to benefit the operation – not the consumers’ need.

The key to success in positioning is to establish some unique element of the product-service mix and promote it. This allows the operation the opportunity to differentiate the product-service mix from that of the competition and thereby gain a competitive advantage. The common term for this approach is a unique selling proposition (USP). With a USP, the operator should use every effort to link the 'benefits' offered with tangible aspects of the product-service mix. Consumers should be able to see, feel, and touch the benefits of the operation as often as possible as opposed to simple hearing marketing messages and slogans.

Develop a Strategy to Obtain Your Position

The final step in the positioning process is to develop strategies for obtaining the desired position that results from the analyses performed in the first three steps. As with any other marketing strategy, the restaurant must use the components of the marketing mix to develop a 'marketing program' to create the total image that the operation can use to achieve the restaurant's objectives. This involves decisions regarding price, product-service mix, promotion, and distribution of information as well as products and services.

Al Ries and Jack Trout (1981) provide a useful set of guidelines to use in developing positioning strategies in their text: Positioning: The Battle for Your Mind. The authors formulated six questions that should be useful to guide your thinking towards the proper positioning scheme that offers the most benefit to your restaurant organization. Figure 5.7 present these six questions along with a detailed rationale for asking them to increase positioning accuracy.

Figure: 5.7 Six Important Positioning Questions to Ask

| What position do you own? | It is critical that you look at the marketplace and your image from the consumer's point of view. How do consumers view your product? What image does your product have in their minds? You must be objective - look at the product from the consumer's perspective. |

|---|---|

| What position do you want? | Those who are most successful tend to carve out a niche of the broad market. Those who attempt to be all things to all people often are not successful. Do not think beyond your organization's capabilities. You must be able to 'own' the position, even if it means displacing a competitor's brand. Not every company can be the leader, but organizations can be successful with other strategies. |

| Whom must you overcome? | No positioning statement exists in a vacuum. You must clearly visualize the positions held by the major competitors. Do they have a firm lock on their positions, or are they vulnerable? If they are strong to avoid a direct frontal, attack and instead go around them. |

| Do you have enough money? | Establishing and maintaining an image in consumers' minds is no small task. Every day we face exposure to hundreds of advertising images. If a change in positioning strategy is the plan, necessary marketing resources must also exist for the change to be successful. |

| Can you continue to compete? | A key to successful positioning is the ability to defend you position. The most successful companies do not change their position, only the short-term tactics they use to communicate their positions. |

| Do you equal your positioning claim? | Critical: The exact positioning statement must form the communication in the advertising and promotions that follow. The desired position should be consistent with the image of the firm and the firm's other products and services. |

One of the most effective ways to change customer perceptions of the product-service mix is through promotion and advertising. For example, Burger King's attempt to differentiate its product-service mix as superior to those of other hamburger restaurants. The focus of Burger King's advertising is centered on charbroiling, its method of cooking hamburgers. The objective of the advertising is to promote the unique process as providing a better-tasking burger of higher quality than its competitors provide.

Another example of using product-service mix positioning is through the approach in which Taco Bell used price and packaging to gain a competitive advantage. At a time when the typical meal at a quick service restaurant costs between $375 and $4.50, Tack Bell took a very different positioning strategy. It introduced a line of value-priced products and meals at price points between 59 and 99 cents. The focus of all promotions and point-of-purchase displays was on low price and value. Because of these promotions, Taco Bell was able to increase its market share, largely at the expense of other fast-food restaurants.